80% of crypto beginners fail | Here’s the Strategy That Works

Welcome to MyKrypto!

Are you a crypto beginner? Have you invested in Cryptocurrency? If yes, then you must have used a certain strategy to avoid loss and make a profit. If your strategy is good enough, then congratulations, but still, there is a scope to learn, right? If you are a complete beginner and have not invested in cryptocurrency yet, then you must equip yourself with this knowledge. So, want to explore? Let’s get started.

Suppose you are a complete beginner, now which platform should you use is the big concern. Of course, for newcomers, the sheer number of platforms, strategies, and risks can be overwhelming. In this guide, we’ll walk you through the basics—starting with how many cryptocurrency platforms exist, how to verify their authenticity, and the strategies that beginners can follow to enter this space wisely.

Now that you are going to start trading in cryptocurrency, you will hear words throughout your cryptocurrency career, such as brokers, exchanges, and the crypto market. You are often confused about how to actually start, as there are multiple platforms available for crypto trading. So, to make it clear, first you need to understand the difference between crypto brokers and crypto exchanges.

Available Platforms

Crypto Broker:

A crypto broker is simply a middleman who has made a platform that allows you to easily trade in cryptocurrencies. Remember, through this platform, you actually trade with the broker itself at a set price, instead of the person who actually has cryptocurrencies, because the platform is simply a middleman, understood? Now you may have a question here: “The middleman will take a cut in profit. Then why are people dealing with them instead of a direct deal in the market?” Yes, you are right, the broker charges a fee, but they provide a beginner-friendly interface, and you don’t need to worry about order books or liquidity. This is a good start for a beginner. So, if you are a complete beginner, initially, brokers are a good choice for you.

Crypto Exchange

A crypto exchange is an actual marketplace where you actually trade cryptocurrencies directly with each other. But here is the catch you need to understand. Crypto exchanges are of two types: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX).

Centralized Exchanges (CEX) are managed by companies, and they are the most common platform due to their user-friendly interface, ease of access to the platform, faster transactions, and better customer support. The companies that run these platforms act as intermediaries but are different from crypto brokers, as CEX helps to match buy or sell orders and charges a trading fee, not a platform fee, unlike brokers. For example, if you want to buy one Bitcoin, on the market marketplace you will place an order to buy, and the system finds someone selling one Bitcoin and simply completes the trade. So actually,y you are directly trading with other traders and not the platform itself. Some examples of CEX are: Binance, Coinbase, KuCoin, etc.

Decentralized Exchanges (DEX), on the other hand, have a different workflow. There is absolutely no middleman, no intermediaries, allowing users to trade directly with other users or traders using smart contracts. It is actually a peer-to-peer model, which gives you full control. The DEX system has the highest privacy and access to tokens, but the sad part is that they have higher transaction fees. Generally, DEX is designed for experienced traders, so beginners might see a very complex dashboard with so many rich options in it, which may confuse beginners. But believe me, once you get a hands on it, you will enjoy trading through such platforms. Some of the DEXs are Uniswap, PancakeSwap, and SushiSwap, which have become central hubs for decentralized finance (DeFi).

Decentralized exchanges (DEX) take a completely different approach by removing intermediaries and allowing users to trade directly from their wallets through smart contracts. This peer-to-peer model ensures that you remain in full control of your funds and private keys, reducing the risk of centralized hacks or asset freezes. While DEXs offer greater privacy and access to tokens that may not be listed on centralized exchanges, they often come with higher transaction fees (especially on Ethereum-based platforms) and can be more complex for beginners. Popular DEXs include Uniswap, PancakeSwap, and SushiSwap, which have become central hubs for decentralized finance (DeFi).

How to Verify a Crypto Platform’s Approval

Unlike the share market or stock market, cryptocurrency is a completely new financial sector blended with advanced technology, without any regulatory body. Many countries have assigned responsibility to their own financial authorities to assist the investors or traders by providing services and support to prevent any scams or vulnerabilities. The Government of India has assigned this task to its Financial Intelligence Unit-India (FIU-IND) or simply FIU. Therefore, if you are trading in India, whatever exchange or platform you are using, always check whether it is FIU-approved or not. If it is not approved by FIU, I would advise you not to trade through such platforms. In the same way, the US government has the Securities and Exchange Commission (SEC) for securities-related digital assets.

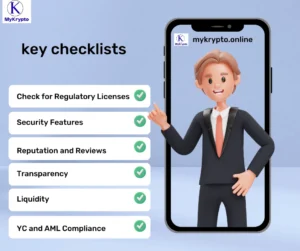

Apart from these, it is also your responsibility to check and verify it properly. Below are some key checklists I am sharing with you.

- Check for Regulatory Licenses:

- Check if the platform you are going to use is registered with financial authorities, like in India, it should be approved by the FIU.

- Security Features:

- It is most important to look for two-factor authentication (2FA), withdrawal whitelists, and insurance policies.

- Research past incidents, such as whether the platform is reliable and whether it would have compensated users in the event of a breach. Also, check if the platform provides insurance coverage for digital assets.

- Reputation and Reviews:

- Check platforms’ reviews on some trusted sites like CoinMarketCap Exchange Rankings or CoinGecko Trust Scores.

- Search community forums on Reddit, Twitter, or Trustpilot for user experiences.

- Transparency:

- Authentic platforms publish clear details about fees, withdrawal policies, and supported countries.

- Many also provide proof-of-reserves audits, showing they hold enough crypto to back user deposits.

- Liquidity:

- Higher trading volumes usually mean more reliable pricing and faster trade execution.

- Avoid exchanges with very low activity—it could indicate poor trust or liquidity.

- Confirm KYC and AML Compliance:

- Authentic platforms publish clear details about fees, withdrawal policies, and supported countries.

- Many also provide proof-of-reserves audits, showing they hold enough crypto to back user deposits.

By applying these checks, beginners can confidently choose a secure platform.

Crypto Beginners Strategies

Now you have researched and decided on your platform to trade through. The next step is to make a plan and strategy to invest smartly and focus more on low-risk strategies. Also check out my blog, Should You Invest in Cryptocurrency? It will help you a lot. Chasing quick profit or huge profit may lead to total loss; instead, focus more on learning with small investments.

1. Start with Education and Small Investments

Begin with a small amount of money you can afford to lose and try to understand how trading works in the crypto world. Throughout the learning, try to figure out what blockchain is. How do wallets work? Learn about wallets and their functions.

2. Dollar-Cost Averaging (DCA)

DCA is one of the simplest and safest strategies for beginners. Instead of buying crypto all at once, you:

Consider your period of investment and follow it thoroughly. It may be a week or a month, as per your convenience, but you should not take into account prices; it may be high or low, never mind, your job is to invest periodically

Over time, this balances out market volatility and lowers the risk of buying at peak prices. For example, consistently buying Bitcoin over a year usually yields better results than trying to “time the market.”

3. Focus on Established Cryptocurrencies

While thousands of altcoins exist, many fail or lose value over time. Beginners should stick to well-known, established coins like:

- Bitcoin (BTC) –trusted everywhere in the world.

- Ethereum (ETH) – the backbone of decentralized applications.

- Stablecoins (USDT, USDC, DAI) – pegged to the U.S. dollar, useful for reducing risk.

Once you gain experience, you can explore promising altcoins, but beginners should avoid meme tokens and low-cap projects

4. Diversify Wisely

Avoid putting all your funds into one cryptocurrency. A simple beginner’s portfolio might look like:

- 50% Bitcoin

- 30% Ethereum

- 20% stablecoins or other top-10 altcoins

This spreads risk while ensuring exposure to the strongest players.

5. Use a Secure Wallet

Leaving your coins on an exchange is risky. For extra safety:

- Hot wallets (apps like Trust Wallet or MetaMask) are good for frequent transactions.

- Cold wallets (hardware wallets like Ledger or Trezor) are best for long-term storage.

As the saying goes: “Not your keys, not your coins.”

6. Avoid Emotional Trading

Crypto markets move fast, and fear or greed can lead to impulsive decisions. Beginners should:

- Avoid chasing “pump and dump” coins promoted on social media.

- Stick to their DCA or long-term holding plan.

- Set realistic goals—crypto is not a get-rich-quick scheme.

7. Learn Basic Risk Management

- Always invest those little amounts that you can bear to lose.

- Always keep an emergency fund outside of crypto.

- Please, please, and please, never ever borrow money for investment, else stop it and do nothing.

8. Explore Staking and Earning Options

Once you’re comfortable, you can use some platforms to earn passive income:

- Staking: Locking coins (like ETH or Cardano) to help secure networks while earning rewards.

- Savings accounts: Some exchanges offer interest on holding stablecoins.

This provides steady returns, but always research the risks before locking your funds.

Common Mistakes Crypto Beginners Should Avoid

- Fall pray to hype the trend easily.

- Using unregulated or unknown platforms.

- Putting life savings into a single coin.

- Ignoring transaction fees, which can eat into profits.

- Forgetting about taxes, crypto gains are taxable in many countries.

Final Thoughts

The cryptocurrency has massive potential, but if you are ready, then prepare yourself for the equal risk as well. If you are a complete beginner, don’t rush quickly. Do your own research, learn techniques and strategies, then start with a little amount, apply what you have learnt, and try to understand the market workflow to build confidence. Avoid emotions and don’t implement any decision emotionally.

Practice success mantra, PCL, i.e, patience, consistency, and continuous learning, often win over quick, risky bets.