The Future of Bitcoin: Can It Reach $1 Million?

Welcome to MyKrypto!

If you are familiar with cryptocurrency or more specifically Bitcoin, you know very well that in 2018, a news headline was circulating everywhere: ” Bitcoin finally crashed, what will be the Future of Bitcoin?” Some newspapers hit headlines with “Crypto Is Now Dead”. From its early years to becoming a multi-billion-dollar asset, the Bitcoin journey is truly iconic and remarkable. But after the 2018 unexpected crash, one question is surely circulating on everyone’s mind: What is the future of Bitcoin, and can it really reach $1 million per coin?

In this article, we’ll discuss the reasons for the Bitcoin crash and try to understand and explore the possibilities, risks, and factors shaping the future of Bitcoin.

A Quick Look Back: Bitcoin’s Journey So Far

Early Days (2009-2012):

2009: Genesis

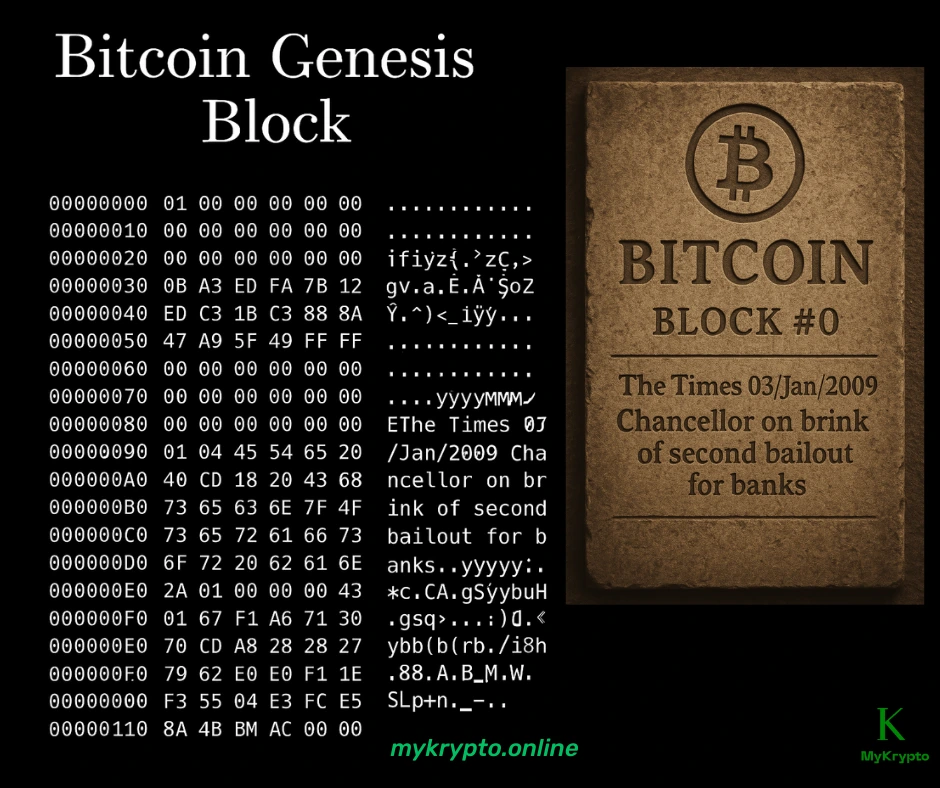

You know Bitcoin was launched on January 3, 2009, and at that time its value was zero. The very first block of the Bitcoin blockchain is known as the “genesis block.” Satoshi Nakamoto had embedded a cryptic message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” It was an attempt to suggest an alternative to the traditional financial system after the 2008 financial crisis. Nakamoto sent 10 BTC to Hal Finney, an early supporter and developer; it was unofficially the very first Bitcoin transaction. After that, early adopters mined blocks and accrued thousands of Bitcoins, but still, Bitcoin was without any real-world value.

I want to share an interesting story from the early days of Bitcoin. Have you heard about “Bitcoin Pizza Day”? I am not joking.

2010: The Bitcoin Pizza Story

The future of Bitcoin is exciting, but its past is just as fascinating. One of the most famous stories in Bitcoin history is the “Bitcoin Pizza Day.”

In May 2010, Florida-based programmerLaszlo Hanyecz posted an offer on the BitcoinTalk forum to give 10,000 BTC, worth just about $40 in total, to anyone who ordered and delivered two pizzas to him. A 19-year-old named Jeremy Sturdivant (username “jercos”) accepted the offer. He ordered two Papa John’s pizzas and had them delivered to Laszlo’s home in Florida. Today, those same coins would be worth hundreds of millions of dollars, making those pizzas the most expensive in history.

2011: The First Bubble and Crash

This year saw Bitcoin’s first major price surge and subsequent crash, a pattern that would become a hallmark of its market. The price rose from around $0.30 at the start of the year to over $1, achieving parity with the U.S. dollar for the first time in February. The momentum continued, with the price peaking at $30 in June before plummeting to a low of $2.50. This steep decline, driven by security breaches and market manipulation on Mt. Gox, taught early adopters a crucial lesson about the volatility of the nascent market. The year also saw the last communication from Satoshi Nakamoto, who told a fellow developer they had “moved on to other projects.” The Bitcoin Foundation was established to promote the currency’s development, and the first darknet market, Silk Road, which exclusively accepted Bitcoin, began operations, attracting a different kind of user and drawing regulatory attention.

2012: The First Halving

2012 was a relatively calm year in terms of price volatility, but it was a crucial one for the protocol itself. On November 28, the first halving event started. This event, programmed into Bitcoin’s code, automatically cut the reward for mining new blocks in half, from 50 BTC to 25 BTC. The halving is designed to reduce the rate of new Bitcoin creation, making it a scarcer asset and controlling its total supply, which is capped at 21 million. The price of Bitcoin started the year at around $5 and ended at about $13.50.

The Rise to Prominence (2013-2017):

2013: The First Major Bull Run

Starting the year at around $13, it surged to over $260 by April, fueled by media attention and growing public awareness. The price then crashed, falling to around $50, before beginning an even more dramatic ascent in the fall. The second surge was driven by the Cyprus financial crisis, which highlighted Bitcoin’s potential as a safe-haven asset. The price reached a new all-time high of $1,242 in November before once again correcting, ending the year around $750. This period also saw the U.S. government seize Bitcoins from the Silk Road, marking a significant moment in the government’s recognition of the asset.

2014-2015: The “Crypto Winter” and Mt. Gox Collapse

This two-year period is often referred to as the first “crypto winter.” The Bitcoin price was in a bear market, and it was for a longer duration. Finally, the price came down to $200. The most important event of that time was the collapse of Mt. Gox. It was really shocking because it was the largest Bitcoin exchange, handling over 70% of all Bitcoin transactions. Can you imagine the situation?. In February 2014, the exchange halted withdrawals and later declared bankruptcy, with a total of 850,000 BTC, worth hundreds of millions of dollars, going missing. The collapse severely damaged the public’s trust in Bitcoin and the broader cryptocurrency market, leading to increased calls for regulation. However, the ecosystem continued to build, with new exchanges and businesses emerging to fill the void left by Mt. Gox.

2016: The Second Halving and Price Recovery

The second halving event, which occurred on July 9, 2016, reduced the block reward from 25 BTC to 12.5 BTC. Leading up to and following the halving, Bitcoin’s price began a slow but steady recovery. The price started the year at around $430 and rose to over $900 by the end of the year. This period saw renewed interest in Bitcoin as a long-term investment. The network’s infrastructure also improved, with the introduction of new scaling solutions and the rise of other cryptocurrencies, or “altcoins,” that began to challenge Bitcoin’s dominance.

The Bull Run and Mainstream Adoption (2017-2021):

2017: The Parabolic Bull Run

The year 2017 was a watershed moment for Bitcoin and the entire crypto industry. The price started at around $1,000 and went on a parabolic run, attracting unprecedented media attention and retail investor interest. Bitcoin’s price surged throughout the year, surpassing major psychological milestones: $5,000 in September, $10,000 in November, and finally reaching an all-time high of nearly $20,000 in December. This explosive growth was driven by a combination of factors, including the launch of Bitcoin futures by major exchanges like the CME and CBOE, and the frenzy of initial coin offerings (ICOs) that saw a flood of money enter the crypto market.

2018: Another Bear Market

Following the incredible high of 2017, the crypto market experienced a brutal crash. Bitcoin’s price plummeted throughout 2018, falling by over 80% from its peak. The market was hit by several headwinds, including increased regulatory scrutiny, security hacks on exchanges, and the bursting of the ICO bubble. The price dropped from over $19,000 to a low of around $3,200 by the end of the year. This period was another “crypto winter,” where many investors and enthusiasts lost money and the media largely wrote off Bitcoin as a failed experiment. However, the underlying technology continued to be developed, and a new wave of institutional investors began to show interest.

2019-2020: Slow Recovery and the COVID-19 Crash

The market began a slow and gradual recovery in 2019, with the price of Bitcoin starting the year low and then rising to a calendar-year peak of around $13,800 in July. The momentum was driven by renewed interest from institutional players and the development of new financial products. The year 2020 was a rollercoaster. The market experienced a significant flash crash in March, known as “Black Thursday,” as global markets tanked at the onset of the COVID-19 pandemic. Bitcoin fell by over 50% in a single day, dropping below $4,000. However, this proved to be a major buying opportunity. As governments around the world implemented massive quantitative easing policies, investors began to see Bitcoin as a hedge against inflation. This narrative, combined with major corporate investments from companies like MicroStrategy and Square, fueled a new bull run. The third halving occurred on May 11, reducing the block reward to 6.25 BTC. By the end of 2020, Bitcoin’s price had once again surged, reaching a new all-time high of over $29,000.

2021: The All-Time Highs and Growing Institutional Adoption

2021 was a historic year for Bitcoin. Its price continued its upward trajectory, fueled by a perfect storm of institutional adoption, retail enthusiasm, and mainstream recognition. The price surged past $40,000 in January and reached new all-time highs of over $64,000 in April, driven in part by Coinbase’s public listing on the Nasdaq. A mid-year correction saw the price fall by more than 50% as China intensified its crackdown on crypto mining. However, the rally resumed in the fall, with the price reaching a new all-time high of nearly $69,000 in November. El Salvador became the first country to adopt Bitcoin as legal tender, a landmark event that signaled the growing acceptance of the digital asset on a global scale.

Current State (2022-Present):

2022-2023: The Bear Market and Regulatory Clarity

The year 2022 was another brutal bear market for Bitcoin. The price steadily declined throughout the year, dropping below $20,000. The downturn was exacerbated by a combination of factors, including rising interest rates to combat inflation, global economic uncertainty, and the collapse of high-profile crypto firms like Celsius, Luna, and FTX. The events of 2022 highlighted the need for greater regulatory clarity and transparency in the crypto industry. In 2023, the market began a slow but steady recovery. The primary catalyst for this rebound was the growing anticipation of a spot Bitcoin ETF approval in the United States. Major asset managers, including BlackRock, filed applications, signaling a significant shift in institutional interest and legitimacy for the asset. The price started to climb, ending the year at over $42,000.

2024-2025: The ETF Breakthrough and Fourth Halving

The beginning of 2024 marked a historic moment for Bitcoin. In January, the U.S. Securities and Exchange Commission (SEC) approved several spot Bitcoin ETFs. This decision was a major breakthrough, making it easier for traditional investors to gain exposure to Bitcoin without having to directly own and store the cryptocurrency. The ETF approval led to a massive influx of capital into the market, pushing the price to new all-time highs. On April 20, 2024, Bitcoin experienced its fourth halving, reducing the block reward from 6.25 BTC to 3.125 BTC. The combination of increased demand from the ETFs and the reduced supply from the halving contributed to an unprecedented price rally. By September 2025, the price of Bitcoin has soared to over $110,000, with a market capitalization exceeding $2 trillion, cementing its place as a significant player in the global financial landscape.

Why People Believe Bitcoin Could Reach $1 Million

1. Scarcity and the Halving Effect

Bitcoin has a built-in mechanism called the halving, which happens approximately every four years. Each halving reduces the number of new Bitcoins entering circulation, making the asset more scarce over time. Historically, these events have triggered major bull runs.

If demand continues to grow while supply gets tighter, Bitcoin’s price could skyrocket. Some analysts believe this scarcity could push Bitcoin toward the $1 million mark in the future.

2. Institutional Adoption

One of the biggest drivers for Bitcoin’s growth is institutional investment. Companies like Tesla, MicroStrategy, and Square have already added Bitcoin to their balance sheets. Investment funds, hedge funds, and even pension funds are exploring Bitcoin as part of their portfolios.

The launch of Bitcoin ETFs in certain countries has also opened the door for everyday investors to gain exposure without directly owning cryptocurrency wallets. If this adoption trend continues, it strengthens the future of Bitcoin as a mainstream asset.

3. Bitcoin as Digital Gold

Many see Bitcoin as a hedge against inflation and economic uncertainty. With governments around the world printing money during crises, fiat currencies risk losing value. Bitcoin’s fixed supply makes it a powerful alternative for wealth preservation.

If Bitcoin captures even a fraction of the gold market’s $13 trillion value, its price could climb into the hundreds of thousands—possibly even reaching that $1 million dream target.

4. Global Acceptance and Regulation

Countries like El Salvador have already adopted Bitcoin as legal tender, and others are experimenting with integrating cryptocurrencies into their financial systems. As regulations become clearer and adoption spreads, the future of Bitcoin looks increasingly strong.

Expert Predictions About the Future of Bitcoin

Financial experts and crypto enthusiasts often debate Bitcoin’s price predictions. Here are some notable ones:

- Cathie Wood (ARK Invest): Predicts Bitcoin could reach $1 million by 2030, driven by institutional adoption.

- PlanB (Stock-to-Flow Model): Suggests Bitcoin could hit anywhere from $500,000 to $1 million in the coming decade.

- Skeptics like Warren Buffett Dismiss Bitcoin as speculative and predict it will eventually lose value.

The truth probably lies somewhere in between. The future of Bitcoin is neither guaranteed success nor certain failure—it depends on adoption, technology, and regulation. I have a dedicated blog on whether you should invest in cryptocurrency. Please do check it out if you are interested.

Challenges That Could Prevent Bitcoin from Reaching $1 Million

While the optimism is strong, Bitcoin faces real challenges:

1. Regulatory Uncertainty

Governments worldwide are still debating how to regulate cryptocurrencies. Stricter rules or outright bans in major economies could slow down adoption and hurt Bitcoin’s future growth.

2. Energy Consumption

Bitcoin mining consumes a massive amount of electricity, raising environmental concerns. Unless mining transitions toward greener energy solutions, this issue could hinder Bitcoin’s acceptance.

3. Competition from Other Cryptocurrencies

Ethereum, Solana, and other blockchain projects offer faster and cheaper transactions. While Bitcoin is the king of crypto, competition could limit its growth as newer technologies evolve.

4. Market Volatility

Bitcoin’s price swings are legendary. Sudden crashes of 50% or more are not unusual. For Bitcoin to reach $1 million, it must overcome the trust barrier created by such volatility.

The Role of Technology in the Future of Bitcoin

See, we all know the 2008 financial crisis, so to overcome the drawbacks of the present financial system, we need to think something out of the box., With that in mind, the Lightning Network of Blockchain technology came into existence. Now, blockchain is transforming other sectors and industries as well. If we talk about Bitcoin, it is not like our country’s currency, which has no control over its printing; certainly, Bitcoin has limitations in speed and scalability.

Will Bitcoin Really Reach $1 Million?

So, is the $1 million target realistic? The answer depends on perspective.

- Optimists argue that Bitcoin’s scarcity, adoption, and global acceptance make $1 million possible within the next decade.

- Skeptics believe volatility, regulation, and competition will keep Bitcoin far below that milestone.

The truth is, Bitcoin has already proven itself as a revolutionary financial asset. Whether it hits $1 million or not, the future of Bitcoin will continue to shape global finance.

Final Thoughts on the Future of Bitcoin

The future of Bitcoin remains one of the most debated topics in the financial world. While it faces challenges, its potential is undeniable. Bitcoin has already changed how we think about money, and its journey is far from over.

Whether it reaches $100,000, $500,000, or even $1 million, one thing is certain: the future of Bitcoin is one worth watching closely.

If you’re considering investing, always remember the golden rule—do thorough research and never invest more than you can afford to lose.