Introduction | Modular Blockchain

Welcome to MyKrypto!

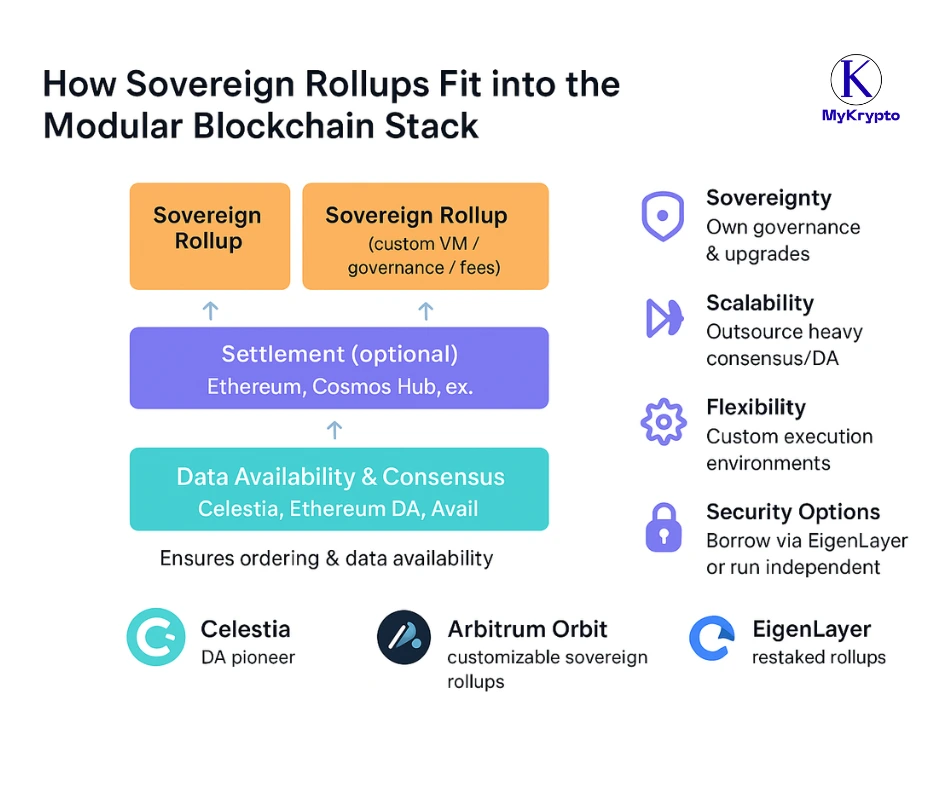

Blockchains are shedding the “one-chain-does-it-all” mindset. The modular blockchain thesis — split consensus, data availability (DA), settlement, and execution into separate layers — promises far greater scalability and specialization than monolithic chains. A particularly striking child of this thesis is the sovereign rollup: an L2 that keeps full control over execution and governance while outsourcing ordering and data availability to a shared DA/consensus layer. In this article, I’ll explain the idea, why it matters, walk through the main technical trade-offs, and review concrete case studies and emerging primitives that show where things might be going. (Celestia)

What is a sovereign rollup — short version

A sovereign rollup is effectively a full, independent blockchain that posts its transaction data to an external data-availability/consensus layer rather than running its own global validator set for everything. That lets the rollup keep bespoke execution rules, governance, fee models, and upgrade paths (hence “sovereign”), while relying on robust DA and ordering from a specialized network. The separation of responsibilities is the essence of the modular blockchain thesis.

Why modularity? The core benefits

- Specialization and efficiency. When networks focus on one function — e.g., Celestia on DA/consensus — they can optimize for that job without constraints imposed by heavy execution logic. This reduces duplicated work across independent chains.

- Faster innovation at the execution layer. Teams can design app-specific execution environments (custom VM semantics, fast finality for some tx types, game-friendly state models) without changing the base-layer consensus rules.

- Composable security models. Shared DA and optional borrowed security (via mechanisms like restaking) allow new chains to launch quickly and cheaply while still inheriting strong guarantees — but with trade-offs (more on that below).

The trade-offs — what modularity buys and costs

- Security vs. Sovereignty: A sovereign rollup can be fully independent in logic but still depends on whatever DA/ordering it uses for censorship resistance and verifiability. If DA is robust, the rollup is safe in terms of data availability; if DA is weak or censored, the rollup can be at risk. Projects mitigate this by choosing mature DA layers or by building fallbacks.

- Finality & Settlement complexity: If settlement (final economic guarantees) happens on one chain while execution happens elsewhere, cross-layer reconciliation and dispute mechanisms must be carefully designed. Different rollup SDKs approach this differently (fraud proofs, zk-proofs, or hybrid models).

- Interoperability friction: Sovereign rollups optimized for specific use-cases may not be directly compatible with each other (different VMs, token formats). Bridges and cross-rollup standards are improving, but the modular world increases heterogeneity. (Arbitrum Docs)

Key building blocks in practice

Data-Availability (DA) layers — the enablers

Networks like Celestia were explicitly built to act as a DA/consensus layer where rollups publish blobs of transaction data. By providing easy-to-verify DA and a light-client-friendly design, Celestia lowers the barrier for rollups to be verifiable without running massive validator sets themselves. This is core to the sovereign-rollup vision. (Celestia)

Rollup frameworks & SDKs

Frameworks such as Arbitrum Orbit, OP Stack, Polygon CDK, and specialized SDKs (Sovereign SDKs) let teams create custom rollups more quickly. Orbit, for example, supports permissionless Arbitrum chains and is explicitly used for app-specific sovereign chains with custom fee tokens, governance, and execution environments. These SDKs reduce friction and operational complexity for teams launching sovereign rollups. (Arbitrum Docs)

Security primitives — restaking and AVS

EigenLayer introduced the idea of restaking, allowing ETH stakers to opt to secure other services (Actively Validated Services, AVS). This creates a security marketplace where rollups or other L2s can borrow Ethereum’s economic security by having validators restake their capital to protect the rollup. That’s a potential shortcut to strong security for new sovereign rollups — but it concentrates risk and introduces complex economic and slashing dynamics. (Nansen)

Case studies and real-world signals

1) Celestia + the sovereign-rollup concept (documentation + dev ecosystem)

Celestia’s own documentation and blog content have promoted the sovereign-rollup model as a natural outcome of modularity: rollups execute however they like but post data to Celestia for availability and ordering. Developers have used Celestia’s BlobTx and pay-for-blobs primitives to post execution traces and state roots — a working example of modular DA in production. This is the most direct, canonical case study for the modular thesis.

2) Arbitrum Orbit: large-scale, practical sovereign chains

Arbitrum’s Orbit SDK is being used widely to launch customizable L2/L3 chains. The Orbit approach shows an alternative path: leverage a mature execution/settlement stack but allow full customization — effectively enabling sovereign-like rollups with strong tooling and bridges into Ethereum’s liquidity. The growth of Orbit-based chains in production demonstrates demand for app-specific sovereign rollups that capture user experience and economic control. (Arbitrum Docs)

3) EigenLayer + AltLayer: “restaked” security for rollups

EigenLayer’s partnerships (e.g., with AltLayer) illustrate a third path: rollups that want Ethereum-level economic security can accept validators who have restaked through EigenLayer. The Defiant reported on EigenLayer enabling “restaked rollups” where rollup security is directly bought from a restaking marketplace. This model can dramatically lower bootstrapping costs for new sovereign rollups but introduces concentrated risk (slashing exposure, correlated failures) and governance complexity. (The Defiant)

Where sovereign rollups shine — killer use cases

- Gaming and real-time applications. Sovereign rollups can adopt execution models (WASM, lower-latency finality, bespoke storage) that are game-friendly while posting DA to a shared layer. Proposals such as “self-sovereign rollups” explicitly target gaming to avoid DeFi-inherited assumptions.

- Verticalized finance rails. Financial protocols that need custom settlement rules, privacy extensions, or unique governance can run on a sovereign rollup and still rely on shared DA for censorship resistance.

- Regulatory or compliance zones. Organizations that need to preserve control over upgrades and dispute resolution, but still want public verifiability, can benefit from the sovereign model.

Open research/unknowns

- Long-term security dynamics. Restaking markets (EigenLayer) creates new systemic risk vectors. What happens if many services depend on the same restaked capital? How do slashing incidents cascade? (Nansen)

- DA censorship resistance at scale. Shared DA layers must remain censorship-resistant and sufficiently decentralized. If DA layers concentrate power, sovereign rollups lose a core safety property. (Celestia)

- Cross-sovereign interoperability. Heterogeneous VMs and state models increase fragmentation. Standards and secure bridges will be necessary to maintain composability across sovereign rollups. (Arbitrum Docs)

Practical advice for teams and builders

- Choose your trust assumptions explicitly. If you post to a public DA like Celestia, you inherit its censorship and availability assumptions. If you opt for EigenLayer restaked security, you inherit restaking economic assumptions. Be explicit in docs and threat models. (Celestia)

- Start with an SDK or RaaS provider. Use Orbit, Sovereign SDKs or RaaS (rollup-as-a-service) platforms to avoid reinventing basic infra — they handle bridges, sequencers, and monitoring so you can focus on execution and UX. (QuickNode)

- Plan for composability early. If you care about liquidity and multi-chain UX, pick execution and token standards that ease bridge-building and composability.

Verdict — Is sovereign rollups’ future the dominant path?

Sovereign rollups are a strong candidate for the future architecture of many scalable blockchains. They embody the practical benefits of modularity: specialization, faster experimentation, and diverse execution environments — and we’re already seeing real, production-grade tooling (Orbit, Celestia DA, Sovereign SDKs) and economic primitives (EigenLayer) that make them viable. However, they are not a silver bullet: security economics, DA-resilience, and interoperability are unsolved system-design problems that will shape winners and losers.

In short: the modular thesis is real, sovereign rollups are viable and growing, but whether they become the dominant pattern depends on how the ecosystem solves security pooling, censorship-resistance, and cross-rollup composability over the next 12–36 months. (Celestia)

Further reading (quick links)

- Celestia — “An Introduction to Sovereign Rollups” and DA explainer. (Celestia)

- Arbitrum Orbit docs — launch your own chain. (Arbitrum Docs)

- EigenLayer & restaking primers — mechanics and AVS examples. (Nansen)

You can also read my article, 80% of Crypto Beginners Fail | Here’s the Strategy That Works.